Shares are a common investment that are entered into with the objective of generating wealth and higher returns than say a term deposit held with a bank.

Unlike Term Deposits, whereby investors are returned with their principal sum plus interest earned over the duration of their investment, Shares can generate a further return on their money as the Share price rises. Higher returns come via this combination of share price growth and of Dividends received.

As with any potential for higher growth, Shares also hold more risk than a typical cash investment. Although shares hold potential for growth, they likewise may encounter price falls, and if an investor is finding they need the cash, and need to sell when the share price has fallen, a loss arises.

Shares can be bought and sold easily on the Australian Stock Exchange (ASX) and often do not require large amounts of money to get started. They often can be held as long as an investor wishes and often investments can span over a lifetime.

Ultimately, shares are an investment or part ownership in a company, typically listed on the ASX. If that company performs well, an investor will benefit. However, if that company performs poorly, the investor will usually lose out.

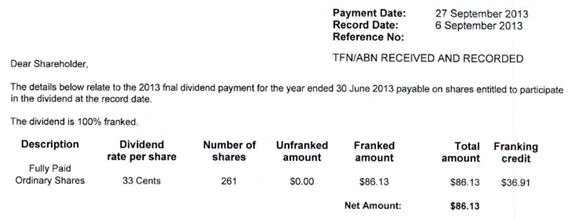

An advantage of Australian listed companies and the Dividends received is the Imputation Credits received by the shareholder. Imputation credits, or franking credits, are a type of tax credit which allows Australian companies to pass on the tax already paid by the company to the shareholder, so as to avoid double taxation.

For example, if you received a fully-franked Dividend of $2,000, this will come with a franking credit of $ 857.14. A total amount of $2,857 will be included in your assessable income.

- If your total taxable income falls within the 19% tax bracket, than you will be entitled to a refund of franking credits of $ 314.31

($2,857 x 19% = 542.83 – $ 857.14 = $ 314.31 refund) - If your total taxable income falls within the 37% tax bracket, that you will have additional tax of $ 199.95 to pay

($ 2,857 x 37% = 1,057.09 – 857.14 = 199.95 payable)

Handy hint *:

- Remember – it is the Payment Date of the dividend that is indicative of the tax year it must be reported as income. Even though the dividend is for the YE 30.06.2013, if it is paid in September 2013, then the income falls in the 2014 tax return.* Please note this Handy Hint only applies to Dividends. Managed fund distributions are typically taxed according to the year in which they relate rather than payment date.